I thought I would pause for a moment from the everyday ordinary occupation of making money through real estate and take notice of the difficult predicaments all around us. One of the principal reasons that the real estate market is in such a state of disarray is our own behavior. Everyday we read about the immoral conduct of our

captains of industry, political leaders and ordinary citizens. It forces me to stop and think about the big picture.

I am a child come of age during the Vietnam War. I had a draft number, marched against Washington and the military industrial complex. Listened to the Beatles. Went to Syracuse University; followed the Dead. Got married. Had three children. Divorced. Got married again and had two more. Lawyer in my middle years, donating to George Bush. Obsessed with success and money. Than tragedy struck. My wife had a brain injury, one of my sons is autistic. I have been forced to really look at my priorities and what is important.

So here we are in the midst of one of the greatest economic dislocations of all times. Opportunities are everywhere. Our economy is resetting and with it many of the old ideas and institutions are either no longer relevant or dysfunctional. Many are suffering.

It is time for each one of us to elevate ourselves and change the world. In order for America and the world to lift itself up out of this monetary nightmare, we must all adopt a better set of ethics and values. Lying must be the exception, and the truth must be the rule of law. I believe many of our problems come from our loss of personal morality. Our leaders feel they can say anything to get elected. Do as they please once in power. That is not a democratic problem, or a republican problem, it is a societal problem. Our captains of industry believe that making money is all that is important, and do not care what happens to their fellow man.

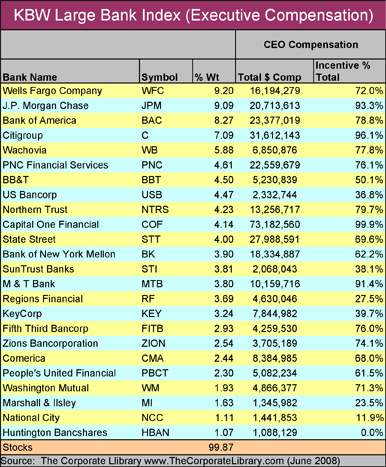

Against the backdrop of the chart I published above is the salaries and benefits being drawn by corporate leaders even of institutions that are failing or performing poorly. Or receiving Government assistance.

It is time for each one of us to adopt a better set of ethics. Each of us must act with integrity and honesty. We must care about our fellow man, and the future of our country, and the world. I am by no means a bleeding heart socialist, liberal. In fact I am a conservative, religious fundamentalist. The Bible,Torah, as well as almost every other holy scripture demands that we act ethically, morally and care for our fellow man.

I can make money by buying and negotiating short sale properties; Arranging private equity loans; Funding for commercial ventures, while at the same time, acting justly, and compassionately. Do I want to acquire more and more capital? You bet I do. But not at the expense of my fellow man, or my country or the world. Together we can pull ourselves out of this mess. Divided, and unwilling to contribute to the goodwill of our society, we are doomed to the dust bin of history!

That's the way I see it. A hippie from the sixties, a conservative in the eighties, and a fundamentalist in the twenty first century.