Those who read this blog know that I am an avid advocate for real estate investing and that I believe that left to its own device the real estate market will correct itself through American ingenuity and capitalism. But with all of the bad news floating about, and a new surge in Bank of America's preforeclosure filings, I feel compelled to say a few more words about my philosophy and opinion of the way forward out of this real estate crisis.

Four years ago I accurately predicted that the real estate bubble would burst, and that the market was going to experience years of price contraction and stagnation. The major banks and many others bet that through government supports and market manipulation that the crisis was temporary, and that after a short dislocation, prices would level off and the market begin to function again. That logic caused lenders to at first foreclose on a huge number of homes, and then hold those properties in inventory waiting for better days to return. How wrong were they!

Now companies such as GMAC now known as ALLY privately predict that the real estate market will not stabilize and function normally until 2012.Over the last two years I have come to the conclusion that unless the Federal Government and Federal Reserve stop intruding in the market that dysfunction may be normalcy. What does that mean to real estate investors and developers? It is my opinion that the focus of investors in this market should be on acquiring wholesale properties that need rehabilitation and also pre-foreclosure and foreclosure properties that require rehabilitation.

Where should you buy these properties? It is important to survey your market and acquire properties only in areas, or zip codes, were sales are still occurring. Areas around colleges, employment centers, transportation hubs and shopping districts, are more desirable, as students need a place to live, employees want to live closer to their work and public transportation is becoming more critical.

We focus are attention on up and coming neighborhoods, targeting more functionally obsolescent properties. This keeps our acquisition cost down, and allows us to concentrate more of our capital on the rehabilitation of the property. Those properties usually have a much greater return on investment, as the final product has a much higher value.

I believe that if Fannie Mae and Freddie Mac would get out of the real estate business, private investment and prudent lending, would right the market faster and more efficiently. But, in the meantime an investor should look for obsolescent properties in good neighborhoods and rehabilitate them and they will get a very nice return on their investment.

Friday, September 16, 2011

BANK OF AMERICA INCREASES PACE OF FORECLOSURE FILINGS..PRE-FORECLOSURE NOTICES UP IN AUGUST.......THE BUBBLE BURST....... HOW CAN WE TURN THE REAL ESTATE MARKET AROUND?

Wednesday, September 7, 2011

US ATTORNEY GENERAL SUES BANK OF AMERICA, CHASE AND OTHER MAJORS WILL IT MAKE A DIFFERENCE?

Last week amid great fanfare the Federal Government filed suit against all of the major lenders claiming they defrauded investors by bundling sub prime loans together and selling them as mortgage backed securities. While the effort is commendable on one hand, the real question is will it be effective and how will it effect homeowners who are facing foreclosure, and the real estate market in general.

I am afraid my readers will not like the answer to either of these questions. One of the biggest problems facing the real estate market over the past four years is the politicization of the foreclosure issue. Four years ago the government proposed the mortgage modification program, Make Home Affordable, in response to a growing storm of political criticism that it was not doing enough to help defaulting homeowners stay in their homes.

Most homeowners who attempted to navigate the highway of that legislation, learned quickly that it was a slow trip to nowhere, and that little help was provided by the lenders or HUD. Instead, the lenders used the program as a personal piggy bank granting as many temporary modifications as they could, until that loop hole was closed, and then refusing to grant the majority of qualified modification requests.

Unfortunately, the government in their rush to address the issue (or parenthetically, because they choose not to) did not include any enforcement penalties in the legislation allowing the lenders to reap the financial benefits from the program without providing homeowners the essential relief they needed. Isn't this the outcome every time the government intervenes in the marketplace to attempt to correct market forces.

If Americans are expecting the government to solve the mortgage foreclosure problem, then good luck to all of us! The law suit may allow Fannie Mae and Freddie Mac to recover some of the ill gotten gains of those who peddled these despicable securities, but I'm not betting on it. The only solution to the current mortgage crisis is to allow the market to unwind naturally. This process will result in prices continuing to fall until the market reaches bottom and then stabilizes. The biggest impediment to that process is the government and lending institutions who are still trying to shirk the consequences of their actions.

If the lenders and the government would allow homeowners to short sale their properties than, the market would retreat in a somewhat orderly fashion. The new mortgages would be based on realistic loan to value ratios, and the real estate markets could begin to function again. This would require both the public and private sector admitting the loss is upon us, and salvaging the distressed assets to begin again. It is akin to realizing that your 1990 Chevy is no longer worth repairing and it is time to trade it in, or send it to the junkyard for $250.00. Or, you could continue to invest in your jalopy and try to sell it for far more than it is worth. Which is the better choice?

When the market is allowed to function as our founding fathers intended, capitalism will cure the mortgage crisis. Only through the force of a free market and the passage of time will this problem be solved.

I am afraid my readers will not like the answer to either of these questions. One of the biggest problems facing the real estate market over the past four years is the politicization of the foreclosure issue. Four years ago the government proposed the mortgage modification program, Make Home Affordable, in response to a growing storm of political criticism that it was not doing enough to help defaulting homeowners stay in their homes.

Most homeowners who attempted to navigate the highway of that legislation, learned quickly that it was a slow trip to nowhere, and that little help was provided by the lenders or HUD. Instead, the lenders used the program as a personal piggy bank granting as many temporary modifications as they could, until that loop hole was closed, and then refusing to grant the majority of qualified modification requests.

Unfortunately, the government in their rush to address the issue (or parenthetically, because they choose not to) did not include any enforcement penalties in the legislation allowing the lenders to reap the financial benefits from the program without providing homeowners the essential relief they needed. Isn't this the outcome every time the government intervenes in the marketplace to attempt to correct market forces.

If Americans are expecting the government to solve the mortgage foreclosure problem, then good luck to all of us! The law suit may allow Fannie Mae and Freddie Mac to recover some of the ill gotten gains of those who peddled these despicable securities, but I'm not betting on it. The only solution to the current mortgage crisis is to allow the market to unwind naturally. This process will result in prices continuing to fall until the market reaches bottom and then stabilizes. The biggest impediment to that process is the government and lending institutions who are still trying to shirk the consequences of their actions.

If the lenders and the government would allow homeowners to short sale their properties than, the market would retreat in a somewhat orderly fashion. The new mortgages would be based on realistic loan to value ratios, and the real estate markets could begin to function again. This would require both the public and private sector admitting the loss is upon us, and salvaging the distressed assets to begin again. It is akin to realizing that your 1990 Chevy is no longer worth repairing and it is time to trade it in, or send it to the junkyard for $250.00. Or, you could continue to invest in your jalopy and try to sell it for far more than it is worth. Which is the better choice?

When the market is allowed to function as our founding fathers intended, capitalism will cure the mortgage crisis. Only through the force of a free market and the passage of time will this problem be solved.

Friday, August 26, 2011

BUFFETT/ BANK OF AMERICA/ MITIGATION FIASCO!

Is that Warren Buffett or Jimmy Buffett investing in bank of America? A young drunk Jimmy Buffett might invest in Bank of America, the older one would not. So it must be Warren Buffett. Are you serious? He should have spoken with one of the thousands of real estate investors, agents and short sale negotiators, who try to deal with B of A before he threw his good money into one of the most inefficiently run companies in the world.

Many very experienced investors and negotiators will not seriously consider an attempted purchase of a Bank of America distressed property. Part of the reason is their fault and part is beyond their control.

When Bank of America purchased Countrywide they really got a bag of bull sh-t. The Countrywide loans are a poisonous swill and, if you have ever attempted to purchase one of these proprieties via a short sale from Bank of America, than you know that they often cannot be significantly discounted. On top of that Bank of America/s short sale department is woefully inept.

The natural result of these two factors is Bank of America carrying a huge number of distressed properties on its books. Competent real estate investors have little interest in buying these properties, because they either can not be significantly discounted, or, Bank of America is so inflexible and disorganized that you can not get an offer approved in a timely fashion. Too big to fail, is also too big to succeed.

For Bank of America to rise from the ashes like a Phoenix it will need the cooperation of the government in discounting the numerous Countrywide loans to permit real estate investors to buy them and, re position them so they can enter into the market again. It will also require Bank of America to reorganize its mitigation efforts, to become user friendly, instead of difficult to work with. In all fairness to Bank of America Chase and many other of the lenders are just as difficult and inefficient to work with, when trying to short sale their properties.

It is clear that the economic crisis and the great recession (really a depression) will not subside until the housing market is stabilized. The housing market will not be stabilized until the distressed property inventories at the banks are liquidated and the real estate market resets. At the current pace, and with the current management, the end appears no where in sight.

Many very experienced investors and negotiators will not seriously consider an attempted purchase of a Bank of America distressed property. Part of the reason is their fault and part is beyond their control.

When Bank of America purchased Countrywide they really got a bag of bull sh-t. The Countrywide loans are a poisonous swill and, if you have ever attempted to purchase one of these proprieties via a short sale from Bank of America, than you know that they often cannot be significantly discounted. On top of that Bank of America/s short sale department is woefully inept.

The natural result of these two factors is Bank of America carrying a huge number of distressed properties on its books. Competent real estate investors have little interest in buying these properties, because they either can not be significantly discounted, or, Bank of America is so inflexible and disorganized that you can not get an offer approved in a timely fashion. Too big to fail, is also too big to succeed.

For Bank of America to rise from the ashes like a Phoenix it will need the cooperation of the government in discounting the numerous Countrywide loans to permit real estate investors to buy them and, re position them so they can enter into the market again. It will also require Bank of America to reorganize its mitigation efforts, to become user friendly, instead of difficult to work with. In all fairness to Bank of America Chase and many other of the lenders are just as difficult and inefficient to work with, when trying to short sale their properties.

It is clear that the economic crisis and the great recession (really a depression) will not subside until the housing market is stabilized. The housing market will not be stabilized until the distressed property inventories at the banks are liquidated and the real estate market resets. At the current pace, and with the current management, the end appears no where in sight.

Tuesday, August 16, 2011

THE CAMBRIDGE STORY? ANATOMY OF A SHORT SALE

On a postlet on the side of this blog is a property 2834 Cambridge Street in Philadelphia, Pa. It is a property in Brewerytown, a gentrifying neighborhood near the Philadelphia Art Museum. It is a short sale property that is being rehabilitated by a cooperative effort of Prime Financial Group LLC and Top Tier Holdings LLC. It is also the perfect example of how a short sale works.

The property was purchased by the previous owner for $235,000.00 in 2007. It had been rehabbed by the seller in 2007, but poorly executed. After the real estate bubble burst the owner could no longer afford to pay the mortgage and it fell into delinquency. Bank of America sold the mortgage to IBM LPBS who pushed forward with a foreclosure. Christine Sherbert, founder of the Montgomery County Real Estate Investors Group, a well known, experienced investor, and re-habber, located the property for the short sale team. In April of 2011, Top Tier Holdings LLC made an offer on the property to IBM LPBS for significantly less than the mortgage pay off amount, of course it was rejected and Prime Financial commenced short sale negotiations on the property on Top Tiers behalf.

IBM LBPS had an interior BPO (Brokers price opinion) for twice what Christine,Top Tier and Prime believed the property was worth. Of course the negotiations bogged down. Prime challenged the BPO and submitted a value challenge, with accompanying comparable prices, and analysis, to IBM LBPS, ultimately convincing IBM to sell Top Tier the property for a fraction of the original IBM value.

Settlement on the property was held in July of this year. With in two days the renovations began on the property by the contractor First Development Corp. The complete exterior/interior rehabilitation will take 6-7 weeks. The funding was provided by a private individuals self directed IRA, with modest cost,s and reasonable interest rate.

At the conclusion of the rehabilitation the property will be worth substantially more than Top Tier Holdings paid IBM LBPS. Jennifer Grosskopf of Coldwell Banker an experienced real estate agent has been engaged as the listing agent for the property. The property will be resold before the snow falls on the ground. All of the participants in the process will profit handsomely for their endeavors.

Cambridge is an example of how team work between an investor, short sale negotiator, builder, and Realtor can result in a successful project. Time and time again I hear experienced real estate investors say; "I hate short sales", not my bag baby. But with team work, and creative thinking, they can utilize this product to share in a handsome profit. Before you write off the opportunities in short sales, consider the power that team work can bring to your real estate endeavors!

The property was purchased by the previous owner for $235,000.00 in 2007. It had been rehabbed by the seller in 2007, but poorly executed. After the real estate bubble burst the owner could no longer afford to pay the mortgage and it fell into delinquency. Bank of America sold the mortgage to IBM LPBS who pushed forward with a foreclosure. Christine Sherbert, founder of the Montgomery County Real Estate Investors Group, a well known, experienced investor, and re-habber, located the property for the short sale team. In April of 2011, Top Tier Holdings LLC made an offer on the property to IBM LPBS for significantly less than the mortgage pay off amount, of course it was rejected and Prime Financial commenced short sale negotiations on the property on Top Tiers behalf.

IBM LBPS had an interior BPO (Brokers price opinion) for twice what Christine,Top Tier and Prime believed the property was worth. Of course the negotiations bogged down. Prime challenged the BPO and submitted a value challenge, with accompanying comparable prices, and analysis, to IBM LBPS, ultimately convincing IBM to sell Top Tier the property for a fraction of the original IBM value.

Settlement on the property was held in July of this year. With in two days the renovations began on the property by the contractor First Development Corp. The complete exterior/interior rehabilitation will take 6-7 weeks. The funding was provided by a private individuals self directed IRA, with modest cost,s and reasonable interest rate.

At the conclusion of the rehabilitation the property will be worth substantially more than Top Tier Holdings paid IBM LBPS. Jennifer Grosskopf of Coldwell Banker an experienced real estate agent has been engaged as the listing agent for the property. The property will be resold before the snow falls on the ground. All of the participants in the process will profit handsomely for their endeavors.

Cambridge is an example of how team work between an investor, short sale negotiator, builder, and Realtor can result in a successful project. Time and time again I hear experienced real estate investors say; "I hate short sales", not my bag baby. But with team work, and creative thinking, they can utilize this product to share in a handsome profit. Before you write off the opportunities in short sales, consider the power that team work can bring to your real estate endeavors!

Wednesday, July 27, 2011

FLORIDA SHORT SALES/CONDO DUES/THE NEGOTIATION WITHIN THE NEGOTIATION

Investors looking to cash in on the collapse of the real estate market in Florida should beware of the condominium fees conundrum. To put it simply, during the default period of the loan the owners often rent out the properties, but do not pay the condominium fees. This means that even after you have negotiated a short sale price with the bank, the issue still remains how to deal with the condo dues and assessments that exist in all planned communities.

You should be aware that the condo association will need a separate authorization to talk to your representative, and then in most cases your call will be referred to their lawyer. The first thing you need to request is a payoff balance. If you request it in writing this is known as a estoppel letter. The condo associations have been so inundated with letter requests that they charge a hefty fee to prepare the estoppel letter. I suggest you let the bank order the estoppel letter.

After obtaining the estoppel figure you have to negotiate the amount of money to be contributed between the condo association and the bank, to resolve the delinquent fees and assessments. Be aware that Florida foreclosure law limits the amount of fees the bank will have to pay if they complete the foreclosure, so the banks will be difficult to negotiate with. On the other hand, if you are making a great deal, the condo association will also be difficult to negotiate with, as they will want to share in your spoils.

On government backed loans their is an interplay between the regulated payoff amount, and the payment of the condo fees. An experienced short sale negotiatior can resolve these issues and insure that your deal does not collapse prior to, or at the settlement table.

You should be aware that the condo association will need a separate authorization to talk to your representative, and then in most cases your call will be referred to their lawyer. The first thing you need to request is a payoff balance. If you request it in writing this is known as a estoppel letter. The condo associations have been so inundated with letter requests that they charge a hefty fee to prepare the estoppel letter. I suggest you let the bank order the estoppel letter.

After obtaining the estoppel figure you have to negotiate the amount of money to be contributed between the condo association and the bank, to resolve the delinquent fees and assessments. Be aware that Florida foreclosure law limits the amount of fees the bank will have to pay if they complete the foreclosure, so the banks will be difficult to negotiate with. On the other hand, if you are making a great deal, the condo association will also be difficult to negotiate with, as they will want to share in your spoils.

On government backed loans their is an interplay between the regulated payoff amount, and the payment of the condo fees. An experienced short sale negotiatior can resolve these issues and insure that your deal does not collapse prior to, or at the settlement table.

Saturday, July 23, 2011

CLOSING FANNIE MAE FREDDIE MAC SHORT SALE PROPERTIES.

Today we closed a Wells Fargo/Fannie Mae short sale. After sitting at the settlement table for two and a half hours waiting for the final sheet to be approved I could not refrain from commenting on my observations. Short sales on government investor properties are tricky. The regulations promulgated by Fannie and Freddie force the lenders through a complex process to insure the final acceptance and payoff of the loss.

Most real estate agents and the majority of title agents, (even the lawyers) have no idea how to resolve issues arising from changes in the settlement sheet that vary from the original short sale approval letter. We are always available to our customers to resolve these issues that arise at closing.

Investors should always stay away from Fannie/Freddie properties as the regulations stifle your ability to wholesale the properties. Conventional loans are far more lucrative and easier to negotiate. But if you find yourself knee deep in the government quick sand we can throw you a tree limb, and drag you out.

There has never been a better moment in my lifetime to invest in real estate, just do not buy retail.

Most real estate agents and the majority of title agents, (even the lawyers) have no idea how to resolve issues arising from changes in the settlement sheet that vary from the original short sale approval letter. We are always available to our customers to resolve these issues that arise at closing.

Investors should always stay away from Fannie/Freddie properties as the regulations stifle your ability to wholesale the properties. Conventional loans are far more lucrative and easier to negotiate. But if you find yourself knee deep in the government quick sand we can throw you a tree limb, and drag you out.

There has never been a better moment in my lifetime to invest in real estate, just do not buy retail.

Wednesday, June 29, 2011

Bank of America? Countrywide Fiasco

Here is the latest news from Bank of America on the Countrywide fiasco. While it settles the law suit between the investors and B of A, it does nothing to help resolve the millions of defaulted homes still in the marketplace.http://www.msnbc.msn.com/id/43569643/ns/business-us_business/

JP MORGAN CHASE OFFERS SHORT SALE INCENTIVES?

Broward and Palm Beach County Foreclosures, short-sales and bank repossessed homes

Chase, Wells Fargo offer borrowers $10,000-$20,000 for short sale closings

June 27, 2011...payments $10,000 to $20,000 if they?ll agree to a short sale, which means they sell the home for less than they owe...re doing homeowners a favor simply by agreeing to a short sale and forgiving the amount they owe.

The Sun Sentinel is reporting that JP Morgan Chase is offering up to $20,000.00 to some Florida homeowners as an incentive to induce them into agreeing to short sale their properties. On the face of it this looks like progress an innovation from a company that is not known for either.

Chase as well as all of the other major lenders is experiencing long judicial delays in Florida before obtaining a foreclosure judgment and sale date. These delays often allow homeowners to live in their properties rent free for up to two or more years. Before we indite the Florida courts it is the shear volume of foreclosures that creates this scenario. Chase figures why not induce a financially distressed homeowner in default into voluntarily selling their home.

On the face of it this seems logical. But their are several underlying problems with this approach. First, if their are condo dues they must be paid prior to the short sale, or negotiated with the condo association's lawyer. This is in stark contrast to the lenders obligation post foreclosure which is limited to one percent of the original mortgage balance, plus maintenance assessments. So buyer and seller be ware of the lurking condo association dues.

Of course the program is not being offered to all defaulting Chase homeowners. However, it doesn't take a vivid imagination to see how a upside down homeowner, who could otherwise afford to pay their mortgage, might take advantage of this program.

Short sales are complicated and homeowners and investors considering the sale or purchase of these properties should consult a experienced short sale negotiator in order to facilitate the approval of their sale.

Thursday, June 16, 2011

BRAGGING RIGHTS/SHORT SALE POWERHOUSE

I try not to use this blog for self promotion. Having said that, let me violate my own rule. Prime Financial Group LLC has been negotiating short sales for investors, owners and Realtors. In the last month Prime has obtained short sale approvals from Wells Fargo, GMAC and IBM LBPS. These approvals have been far below market value creating equity opportunity for our investors.

We see the lender turn around time improving, and our results can be attributed to our unique proprietary formula for evaluating properties, submitting short sale packages and negotiating final approvals. If you are seeking a short sale purchase, as an investor,or trying to sell a short sale as a Realtor or owner, we have a program for you. We have proven results, and our approvals are always substantially below fair market value.

If you are in the short sale business, you should not miss the opportunity to call us and see what we can do for you! 267-205-6101.

We see the lender turn around time improving, and our results can be attributed to our unique proprietary formula for evaluating properties, submitting short sale packages and negotiating final approvals. If you are seeking a short sale purchase, as an investor,or trying to sell a short sale as a Realtor or owner, we have a program for you. We have proven results, and our approvals are always substantially below fair market value.

If you are in the short sale business, you should not miss the opportunity to call us and see what we can do for you! 267-205-6101.

Sunday, June 12, 2011

MODIFICATIONS ARE NOT IN FAVOR AT THE BIG THREE.

Many homeowners have operated on the belief that their loan will be modified by their lender. The reality is just the opposite. Lenders have little or no incentive to modify loans as the statistics have shown that the modified loans are highly likely to default.

Most of the modified loans are so upside down, ( negative loan to value) that a modification was not in the owners economic interest in the first place. The truth is that good economic decision making is often cast aside when making decisions about your home. After all, home is where the heart is.

The Chicago Tribune reports that the FED is withholding payments from the three largest banks for poor performance reviews on their HAMP reviews. This further reinforces the point that I have been making that short selling these properties is an essential component of restoring this country to economic health. A bloated defaulted real estate market is dragging the entire United States economy down. The banks are still withholding 3 million plus vacant homes from the market out caution for a second large reduction in residential real estate prices which would be spurned by the exposure of these properties to the market.

Owners who are in distress should strongly consider short selling their property.

Sunday, June 5, 2011

WHEN ARE WE GOING TO GET IT!

I have been reporting for the past three years that the mortgage crisis has been driven by unemployment and underemployment. Now the geniuses in the main street media and the Government are suddenly reporting that the mortgage crisis is employment driven. Does this frighten you? It should? These are the people we are expecting us to lead us out of the great recession or the depression, whatever nomenclature you wish to use to describe it.

Here is a sample of the light bulb coming on in the main stream media. The reality of the situation is that housing prices are going to continue to retreat until two things start happening. First, employment must improve and not jobs like working at McDonalds, unless you are expecting people to work a 120 hour work week. Second, the already bloated and growing inventory of foreclosure and pre-foreclosure residential and commercial real estate must be liquidated by the lenders or owners.

Until the inventory is sold and the prices become commensurate to the current market conditions, grid lock will continue. Their has never been a better time to buy distressed real estate in the last fifty years. What are you waiting for?

Here is a sample of the light bulb coming on in the main stream media. The reality of the situation is that housing prices are going to continue to retreat until two things start happening. First, employment must improve and not jobs like working at McDonalds, unless you are expecting people to work a 120 hour work week. Second, the already bloated and growing inventory of foreclosure and pre-foreclosure residential and commercial real estate must be liquidated by the lenders or owners.

Until the inventory is sold and the prices become commensurate to the current market conditions, grid lock will continue. Their has never been a better time to buy distressed real estate in the last fifty years. What are you waiting for?

Monday, May 23, 2011

NEW FORECLOSURE TSUNAMI TO HIT OUR SHORES

The New York Times is reporting what most savvy real estate investors already new, a giant second and third wave of foreclosures is poised to hit the market as banks continue to take homes at a alarming rate. What that mean to real estate investors is three to five years of declining market values throughout mos of the United States. IS this a good time to buy?

The answer is no, if you are buying retail or slightly below retail values. If you are buying short from the lenders then you can take advantage of the greatest opportunity in real estate investing in the past fifty years. Of course to buy short from the bank, you really need the help of experienced short sale specialists.

A experienced short sale specialist will not just get you a small discount off the fair market value they will obtain a spread that allows you to re wholesale the property.If you have been sitting on the sidelines now is the time to act!

The answer is no, if you are buying retail or slightly below retail values. If you are buying short from the lenders then you can take advantage of the greatest opportunity in real estate investing in the past fifty years. Of course to buy short from the bank, you really need the help of experienced short sale specialists.

A experienced short sale specialist will not just get you a small discount off the fair market value they will obtain a spread that allows you to re wholesale the property.If you have been sitting on the sidelines now is the time to act!

Thursday, May 12, 2011

FORECLOSURE FLAWS

In case you think the foreclosure mess is going away anytime soon, here is the answer. http://blogs.wsj.com/developments/2011/05/12/fdics-bair-millions-of-foreclosures-could-be-infected/?mod=WSJBlog

Monday, May 9, 2011

Home values see biggest drop since 2008

Zillow has reported the biggest drop in home values since 2008. This further supports my earlier prediction that values will not stabilize anytime soon. In fact values declined in every major market other than Honolulu, Hawaii, Fort Meyers, Florida and Champagne, Illinois. Zillow estimates that the market will not stabilize before 2012 and to this writer that is optimistic at best. Never has their been a greater opportunity to capitalize on the instability of the real estate markets.

Lenders have incredible inventories and this news can not make them bullish on taking more properties into their R.E.O. inventory.

Lenders have incredible inventories and this news can not make them bullish on taking more properties into their R.E.O. inventory.

NO END IN SIGHT FOR FORECLOSURE QUAGMIRE

In a statement of the most obvious the main stream press announced today that their is no end in sight to the foreclosure quagmire. Really? This news is no shock to savvy real estate investors who have watched from a distance as the major lenders have only casually tried to address a human crisis of great proportion.

If you know someone who has tried to get a modification than you have heard the story, so I will not bore you with it here. It is abundantly clear that the distressed real estate owners need to short sell their properties in order to reduce their exposure. By short selling the distressed properties the market will come to an equilibrium.

The downward trend in values will continue at least for the foreseeable future. The market will not stabilize until the inventory and shadow inventory has been turned over. If the market is to stabilize in the near future it will result from investors buying the available inventory, at reduced prices, and wholesaling the inventory to the general market. Current market conditions make retail real estate sales very unattractive.

If you know someone who has tried to get a modification than you have heard the story, so I will not bore you with it here. It is abundantly clear that the distressed real estate owners need to short sell their properties in order to reduce their exposure. By short selling the distressed properties the market will come to an equilibrium.

The downward trend in values will continue at least for the foreseeable future. The market will not stabilize until the inventory and shadow inventory has been turned over. If the market is to stabilize in the near future it will result from investors buying the available inventory, at reduced prices, and wholesaling the inventory to the general market. Current market conditions make retail real estate sales very unattractive.

Tuesday, April 19, 2011

SHORT SALES ARE BETTER THAN REOS

It is a simple fact that short sales realize more money for a lending institution than can be realized by the sale of the property after foreclosure. When a lender sells a property after foreclosure the property is described as a REO. Lenders have been slow to dedicate sufficient resources to staff short sale departments and thus response times are woefully slow. John McGeough and Anthony Lamacchia, founders of McGeough Lamacchia Realty Inc. traveled to Washington, D.C., last week to educate policy makers on the benefits of short sales.

McGeough Lamacchia Realty is a full-service real estate firm in Waltham, Massachusetts, specializing in short sales. The company’s two principals conducted meetings with officials at Capitol Hill, the FDIC, the U.S. Treasury, and the National Association of Realtors.

McGeough Lamacchia Realty is a full-service real estate firm in Waltham, Massachusetts, specializing in short sales. The company’s two principals conducted meetings with officials at Capitol Hill, the FDIC, the U.S. Treasury, and the National Association of Realtors.

Their testimony demonstrated the increase in revenue experienced by banks who approve short sales as compared to REO proceeds. According to the analysis, if one-third of the 94,428 lender-owned properties in the sample area — or 31,161 properties — sold as short sales, lenders could gain an additional $1,547,305,687 in revenue.

“Considering all of the political attention in our country over the debt and the budget, promoting short sales should be a high priority for all of our lawmakers in Washington,” said Lamacchia.

Clearly, the lenders should focus more of their effort on short sales in order to reduce the inventory of defaulting properties and resurrect the stalled real estate market.

Saturday, April 16, 2011

WE LIVE IN DIFFICULT TIMES

I thought I would pause for a moment from the everyday ordinary occupation of making money through real estate and take notice of the difficult predicaments all around us. One of the principal reasons that the real estate market is in such a state of disarray is our own behavior. Everyday we read about the immoral conduct of our captains of industry, political leaders and ordinary citizens. It forces me to stop and think about the big picture.

I am a child come of age during the Vietnam War. I had a draft number, marched against Washington and the military industrial complex. Listened to the Beatles. Went to Syracuse University; followed the Dead. Got married. Had three children. Divorced. Got married again and had two more. Lawyer in my middle years, donating to George Bush. Obsessed with success and money. Than tragedy struck. My wife had a brain injury, one of my sons is autistic. I have been forced to really look at my priorities and what is important.

So here we are in the midst of one of the greatest economic dislocations of all times. Opportunities are everywhere. Our economy is resetting and with it many of the old ideas and institutions are either no longer relevant or dysfunctional. Many are suffering.

It is time for each one of us to elevate ourselves and change the world. In order for America and the world to lift itself up out of this monetary nightmare, we must all adopt a better set of ethics and values. Lying must be the exception, and the truth must be the rule of law. I believe many of our problems come from our loss of personal morality. Our leaders feel they can say anything to get elected. Do as they please once in power. That is not a democratic problem, or a republican problem, it is a societal problem. Our captains of industry believe that making money is all that is important, and do not care what happens to their fellow man.

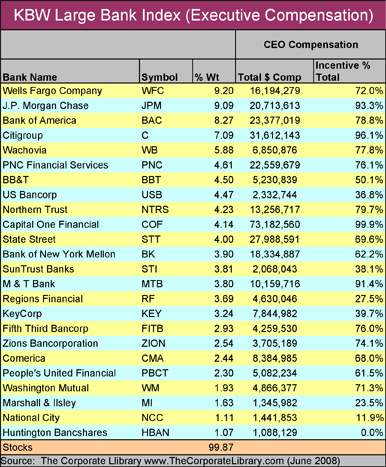

Against the backdrop of the chart I published above is the salaries and benefits being drawn by corporate leaders even of institutions that are failing or performing poorly. Or receiving Government assistance.

It is time for each one of us to adopt a better set of ethics. Each of us must act with integrity and honesty. We must care about our fellow man, and the future of our country, and the world. I am by no means a bleeding heart socialist, liberal. In fact I am a conservative, religious fundamentalist. The Bible,Torah, as well as almost every other holy scripture demands that we act ethically, morally and care for our fellow man.

I can make money by buying and negotiating short sale properties; Arranging private equity loans; Funding for commercial ventures, while at the same time, acting justly, and compassionately. Do I want to acquire more and more capital? You bet I do. But not at the expense of my fellow man, or my country or the world. Together we can pull ourselves out of this mess. Divided, and unwilling to contribute to the goodwill of our society, we are doomed to the dust bin of history!

That's the way I see it. A hippie from the sixties, a conservative in the eighties, and a fundamentalist in the twenty first century.

I am a child come of age during the Vietnam War. I had a draft number, marched against Washington and the military industrial complex. Listened to the Beatles. Went to Syracuse University; followed the Dead. Got married. Had three children. Divorced. Got married again and had two more. Lawyer in my middle years, donating to George Bush. Obsessed with success and money. Than tragedy struck. My wife had a brain injury, one of my sons is autistic. I have been forced to really look at my priorities and what is important.

So here we are in the midst of one of the greatest economic dislocations of all times. Opportunities are everywhere. Our economy is resetting and with it many of the old ideas and institutions are either no longer relevant or dysfunctional. Many are suffering.

It is time for each one of us to elevate ourselves and change the world. In order for America and the world to lift itself up out of this monetary nightmare, we must all adopt a better set of ethics and values. Lying must be the exception, and the truth must be the rule of law. I believe many of our problems come from our loss of personal morality. Our leaders feel they can say anything to get elected. Do as they please once in power. That is not a democratic problem, or a republican problem, it is a societal problem. Our captains of industry believe that making money is all that is important, and do not care what happens to their fellow man.

Against the backdrop of the chart I published above is the salaries and benefits being drawn by corporate leaders even of institutions that are failing or performing poorly. Or receiving Government assistance.

It is time for each one of us to adopt a better set of ethics. Each of us must act with integrity and honesty. We must care about our fellow man, and the future of our country, and the world. I am by no means a bleeding heart socialist, liberal. In fact I am a conservative, religious fundamentalist. The Bible,Torah, as well as almost every other holy scripture demands that we act ethically, morally and care for our fellow man.

I can make money by buying and negotiating short sale properties; Arranging private equity loans; Funding for commercial ventures, while at the same time, acting justly, and compassionately. Do I want to acquire more and more capital? You bet I do. But not at the expense of my fellow man, or my country or the world. Together we can pull ourselves out of this mess. Divided, and unwilling to contribute to the goodwill of our society, we are doomed to the dust bin of history!

That's the way I see it. A hippie from the sixties, a conservative in the eighties, and a fundamentalist in the twenty first century.

Tuesday, April 12, 2011

SHORT SALE STRATEGIES FOR INVESTORS AND OWNERS

As we rapidly approach the middle of the year lenders are still maintaining huge inventories of pre-foreclosure properties. Many investors, real estate professionals and analysts wonder when will this inventory be reduced? We submit short sales for investors, and agents, to major lenders on a daily basis. Despite the record inventory and the shadow inventory, short sales are still being parsed out.

In order to obtain a short sale approval you must run a gauntlet of lender red tape and hurdles. The system is still woefully inefficient, lacks uniformity and herculean requires diligence and perseverance to obtain an approval. Whether you are trying to navigate Bank of America's Equator or any other lenders system the lack of coordination, uniformity and coherency is obvious.

I do not recommend that a agent or investor negotiate his or her own short sale. Short sale negotiation is an art form. A well negotiated short sale will result in the investor or owner achieving a substantial discount from the

projected fair market value of the property. Selling or buying a property is a completely different animal from obtaining a short sale approval. Here is a article with links that illustrates the complexity of obtaining a short sale approval. If you need competent, efficient short sale support call me at 267-205-6101.

In order to obtain a short sale approval you must run a gauntlet of lender red tape and hurdles. The system is still woefully inefficient, lacks uniformity and herculean requires diligence and perseverance to obtain an approval. Whether you are trying to navigate Bank of America's Equator or any other lenders system the lack of coordination, uniformity and coherency is obvious.

I do not recommend that a agent or investor negotiate his or her own short sale. Short sale negotiation is an art form. A well negotiated short sale will result in the investor or owner achieving a substantial discount from the

projected fair market value of the property. Selling or buying a property is a completely different animal from obtaining a short sale approval. Here is a article with links that illustrates the complexity of obtaining a short sale approval. If you need competent, efficient short sale support call me at 267-205-6101.

Friday, April 1, 2011

Pennsylvania/Philadelphia Short Sales

Some people think that short sales are a virus. Especially real estate agents. In the greater Philadelphia area and in Pennsylvania there are many short sale opportunities for the savvy investor or bird dog. In Philadelphia you can find short sales opportunities by checking the Philadelphia and surrounding counties civil docket filings. When you find a house that has a foreclosure filing, you can locate it on Zillow or some other real estate website and determine its estimated value. If the mortgages exceed the value, and they usually due, you have a short sale candidate.

After you find a candidate you can call me to discuss its viability for resale at a profit. The viability of a property to resell for a profit depends on its location,condition, and the lender who holds the mortgage.Some lenders are more realistic about the value of their collateral than others. If the property is a good target we will make an offer to purchase the property and protect a handsome fee, for your participation in the transaction.

If you want to buy your own properties we will negotiate the short sale for you.

All it takes to prosper in the Philadelphia real estate market is, energy, tenacity and a network of real estate investors. If you have an interest in learning the short sale business call me at 267-205-6101.Win your own financial independence.

After you find a candidate you can call me to discuss its viability for resale at a profit. The viability of a property to resell for a profit depends on its location,condition, and the lender who holds the mortgage.Some lenders are more realistic about the value of their collateral than others. If the property is a good target we will make an offer to purchase the property and protect a handsome fee, for your participation in the transaction.

If you want to buy your own properties we will negotiate the short sale for you.

All it takes to prosper in the Philadelphia real estate market is, energy, tenacity and a network of real estate investors. If you have an interest in learning the short sale business call me at 267-205-6101.Win your own financial independence.

Tuesday, March 22, 2011

SHORT SALE BASICS

MSN money published a informative article about short sales. While it is a very basic outline, I include it here as a resource for the inquisitive who want to begin learning about the short sale process. It looks at a short sale from the perspective of the lender, buyer and owner. It describes the process as win, win, win, a description that not only Charlie Sheen could love. http://articles.moneycentral.msn.com/Banking/HomebuyingGuide/UseAShortSaleToEscapeForeclosure.aspx

Technorati Claim Token: 32YWVAGFE4EY

Technorati Claim Token: 32YWVAGFE4EY

Wednesday, March 16, 2011

SHORT SALES ARE AN ART FORM

When you surf the net today you run into all sorts of short sale Svengalis. They ply their trade with video tapes, webinars, auto e-mailers. Where did they all come from? After all when the real estate market was rising there were no short sales. So essentially, it is a two to four year old market place. In many instances these experts are Realtors, mortgage brokers and unemployed white collar workers from various industries. The one thing they have in common is they are self proclaimed experts.

A short sale specialist should have banking loss mitigation experience, legal experience, and most importantly negotiating experience. Unfortunately, this is for the most part in short supply. It is not simply a matter of submitting your documents to the lender, after all you can do that yourself. It is about understanding the

metrics of loss mitigation, and having the tools to analyse the transaction, and present it to the lender in a coherent and professional manner. Your short sale specialist should have access to the latest real estate valuation and management software. The should be versed in the net REO value that the bank is projecting on the property.

Do not just choose by who has the sexiest web site, or the catchiest name, choose an experienced negotiator with the necessary tools and training to get your short sales approved in the most timely and economical manner.

A short sale specialist should have banking loss mitigation experience, legal experience, and most importantly negotiating experience. Unfortunately, this is for the most part in short supply. It is not simply a matter of submitting your documents to the lender, after all you can do that yourself. It is about understanding the

metrics of loss mitigation, and having the tools to analyse the transaction, and present it to the lender in a coherent and professional manner. Your short sale specialist should have access to the latest real estate valuation and management software. The should be versed in the net REO value that the bank is projecting on the property.

Do not just choose by who has the sexiest web site, or the catchiest name, choose an experienced negotiator with the necessary tools and training to get your short sales approved in the most timely and economical manner.

Saturday, March 12, 2011

TSUNAMI MORTGAGE MELTDOWN

The Japanese earthquake and tsunami are certain to have a lasting impact on the Japanese real estate market. But the reality is that the United States is facing a tsunami of its own, in the form of the commercial and residential mortgage meltdown which is gathering steam everyday. This meltdown has created one of the greatest opportunities in real estate investing in the last hundred years.

In all of the Untied States, and much of Europe, opportunities exist to purchase distressed real estate at a fraction of their ultimate value. A savvy investor can orchestrate profits by seeking out valuable properties that are distressed, and then re marketing them for a significant profit. I am sure we are all weary of the late night TV gurus trumpeting how to get rich in real estate with no money down. But this is truly a moment in time, and an opportunity to do just that.

Anytime money is flowing, opportunities abound. At the moment the greatest transfer of real estate equity in history is occurring. Homeowners have seen their equity virtually wiped out. Where did it go, and when will it return? An experienced real estate investor can purchase these homes from the owner, with the their lenders approval for a fraction of their current worth, and resell them at a tidy profit. If you want to learn how you can find these properties and make a profit. Call me at 267-205-6101.

In all of the Untied States, and much of Europe, opportunities exist to purchase distressed real estate at a fraction of their ultimate value. A savvy investor can orchestrate profits by seeking out valuable properties that are distressed, and then re marketing them for a significant profit. I am sure we are all weary of the late night TV gurus trumpeting how to get rich in real estate with no money down. But this is truly a moment in time, and an opportunity to do just that.

Anytime money is flowing, opportunities abound. At the moment the greatest transfer of real estate equity in history is occurring. Homeowners have seen their equity virtually wiped out. Where did it go, and when will it return? An experienced real estate investor can purchase these homes from the owner, with the their lenders approval for a fraction of their current worth, and resell them at a tidy profit. If you want to learn how you can find these properties and make a profit. Call me at 267-205-6101.

Wednesday, March 9, 2011

FIND SHORT SALES - MAKE MONEY

On March 3, 2011 I posted some examples of short sales that we negotiated for our investors. But do not let the terms investor fool you. Our investors invest their time and energy, not necessarily money in their deals. Are you good at following simple directions. Can you help homeowners fill out forms? Does making 40 percent of a short swing profit from a short sale interest you?

Our business model lets allows our partners to find potential short sale properties. Properties that are in pre-foreclosure or foreclosure status, and then watch us do the work You can get involved as little or as much as you want. It is a epic opportunity for a energetic, independent, profit minded individual. We will even help you with your marketing strategy and plan. Give me a call and start filling your pipeline today, 267-205-6101

Our business model lets allows our partners to find potential short sale properties. Properties that are in pre-foreclosure or foreclosure status, and then watch us do the work You can get involved as little or as much as you want. It is a epic opportunity for a energetic, independent, profit minded individual. We will even help you with your marketing strategy and plan. Give me a call and start filling your pipeline today, 267-205-6101

Thursday, March 3, 2011

INVESTOR PARADISE/ JOIN OUR TEAM

The current major problem in the real estate market is the large percentage of houses that are worth less than their sum of their mortgages. This creates marketplace gridlock and makes it difficult to sell the properties. The difficulty arises because of the unknown short payoff amount the lender will accept. This deters Realtors from listing the properties, and buyers from making offers on them. The solution is the growing number of Investors who are driving the real estate market by utilizing transactional funding to obtain short sale approvals, and then marketing, wholesaling or selling the property at a premium to a third party.

Lets examine two deals that we obtained approvals for this week:

The first home is located in the South and has a market value of $125,000.00 the mortgage balance was $135,000.00 The home was in need of some repairs. In two weeks we obtained an approval for our customer to buy the home for $25,000.00 the mortgage payoff is $16,500.00. The customer will make standard improvements and have the ability to retail the property at $100,000.00 with a gross profit of around $50,000.00 the investor can also just sell the property with the estimate as is and make a spread of around $25,000.00. That is a great example of how private enterprise can solve the current residential real estate grid lock.

The second example is a home in the Northeast. The home is worth approximately $275,000.00 it needs little improvement. The mortgage payoff is $350,000.00. We negotiated a purchase at $199,000.00 with a payoff of $167,000.00. The investor will realize a short swing profit of approximately $35,000.00.

These transactions and profits were made with no money down! Their has never been a better time to be in real estate investing. Money is flowing and you must get to the spot you can take advantage of it. Join our team and we will help you make spectacular profits. Call: 267-205-6101 or log on at www.shortsalesclose.com and leave an e-mail.

Lets examine two deals that we obtained approvals for this week:

The first home is located in the South and has a market value of $125,000.00 the mortgage balance was $135,000.00 The home was in need of some repairs. In two weeks we obtained an approval for our customer to buy the home for $25,000.00 the mortgage payoff is $16,500.00. The customer will make standard improvements and have the ability to retail the property at $100,000.00 with a gross profit of around $50,000.00 the investor can also just sell the property with the estimate as is and make a spread of around $25,000.00. That is a great example of how private enterprise can solve the current residential real estate grid lock.

The second example is a home in the Northeast. The home is worth approximately $275,000.00 it needs little improvement. The mortgage payoff is $350,000.00. We negotiated a purchase at $199,000.00 with a payoff of $167,000.00. The investor will realize a short swing profit of approximately $35,000.00.

These transactions and profits were made with no money down! Their has never been a better time to be in real estate investing. Money is flowing and you must get to the spot you can take advantage of it. Join our team and we will help you make spectacular profits. Call: 267-205-6101 or log on at www.shortsalesclose.com and leave an e-mail.